Monkey See, Monkey Do?

Proper Preparation Precedes Powerful Performance

By Mark Phillips / Published September 2023

Well, to be honest, as I entered this facility in the adjacent picture in South Florida soon after hurricane damages arising from 2005 storms, I had no concept of what a biopharmaceutical “monkey farm” would look like. After entering through the gated secure doors on my way to meet with the executive director of this world-class enterprise, one of the largest in the world, I could sense that this operation had many hundreds of furry club members.

This was indeed a very large monkey farm, with over 20 independent caged villages for over 1,500 monkeys of various species and spunk. A zoo-like encounter for sure and a definite first in my large loss adjusting career encounters.

This was indeed a very large monkey farm, with over 20 independent caged villages for over 1,500 monkeys of various species and spunk. A zoo-like encounter for sure and a definite first in my large loss adjusting career encounters.

Also, one of the funniest “monkey jokes” I’ve ever heard was cutely relayed to me by the director as we got acquainted to discuss their most current 2005 Katrina-related damages. “You know, Mark,” the director began, “that 1992 Hurricane Andrew storm completely wiped this campus out—bare to the ground—and we lost the total population of over 1,500 members, scattered to the jungle fields out there. It was all out destruction to these cages; all the critters were gone.”

I awaited the rest of the story—he had me hooked. He continued, “But you know, sir, it only took three days for all of them to come limping back onto this campus—all of them but four promptly returned. It only took them three days to see that there’s no free lunch out there!”

He got me good. We had a robust chuckle and a fond memory together. But there would be no more fond memories.

During a private meeting with him back in his office,

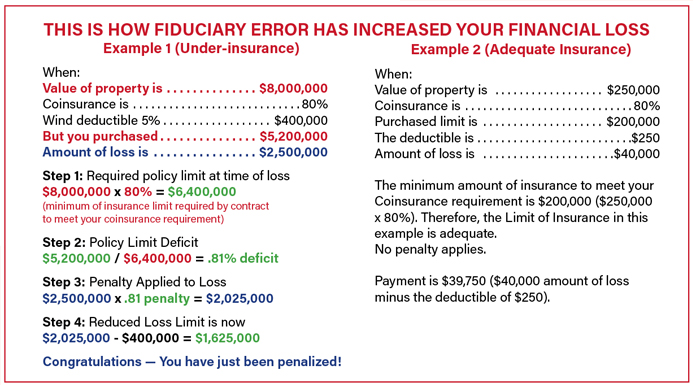

Editor’s Note: The article “The Penalty Dilemma of Replacement Cost Valuation at Time of Loss” was published in the June 2023 issue. On page 81 the graphic that showed how a fiduciary error has increased your financial loss was published with two examples and example 1 in the line “But You Only Purchased” contained an incorrect amount. That has been corrected and republished here. To read the entire article, visit fcapgroup.com/flcaj/flcaj-articles/the-penalty-dilemma-of-replacement-cost-valuation-at-time-of-loss.

I explained the unique but confusing outline of his coverages. The confusion for him came from the fact that all cages were listed on the Declarations of Coverage (referred commonly in the industry as “Dec Pages”) as “separate insured locations” on the campus, not all “one location combined.” While it might not seem like a serious issue at a first reading, the implications of the definition in coverage designs of “Location 1 Insured Value: $ ________” and then “Location 2 Insured Value: $ _________” and so on had huge ramifications. This resulted in a cumulative listing of 20-plus individual cages, sheds, and storage buildings on the Declarations page with over $350,000 in combined values to these units, including the main administrative offices building.

The design of this policy exposed a great deficit in the performance of payments for this loss. Since the “wind deductible” would be applied on “each location”—and the “policy loss-occurrence deductible” would also be applied to “each location” on top of the wind deductible—the adjusted final settlement payment didn’t even cover the replacement cost for one of the cage units!

You should now sense the lump in your throat arising with alarm much as it did in his stunned moments of silence after I delivered to him this limiting contractual design in his policy. His confused but infuriating declaration, “Oh my goodness, we’ve haven’t seen our agent in nine years! This is the result of us making routine renewal payments without our analysis of these crushing deductible definitions in our wind policy.”

This story increased in agonizing emotion when he declared his horror in having to relay this loss adjustment bad news to the board of directors’ annual meeting in the following week.

Mark Phillips

Founder/Publisher, Claims GPS

With 30 years of expansive work in the property and casualty field of insurance, his claims adjusting experience since 1996 encompasses large property damage and business interruption losses arising from numerous catastrophic disasters throughout America. He is author/creator of the Claims GPS educational system, which offers policyholders guidance, preparation, and success in fulfilling their duties during their claims recovery event.

He has created the innovative case study workshop titled “Duties of the Insured: Coconut Twist—The Truth and Trauma of a Hurricane Claim,” graphically displaying the errors and omissions liabilities for directors and officers due to lack of preparation for recovery under their commercial insurance policy.

For more information about Claims GPS, contact Mark Phillips at 813-532-5023 or email mphillipswka@yahoo.com.